New feature

Simplify estate discovery

Access a deceased individual’s financial information, from bank accounts to mortgages, directly on the platform at the click of a button, simplifying your estate discovery.

"We've used Estate discovery in cases where we didn't know about any assets or liabilities. It was fantastic, we located the deceased's main bank account and some credit cards straight away.

It's incredibly useful and gives us results within seconds instead of weeks - we're going to save a lot of time"

- Hayley Palmer, Probate Executive

.png?width=251&name=GloverPriest-Logo_Dark%20(1).png)

Locate assets and liabilities, without the hassle

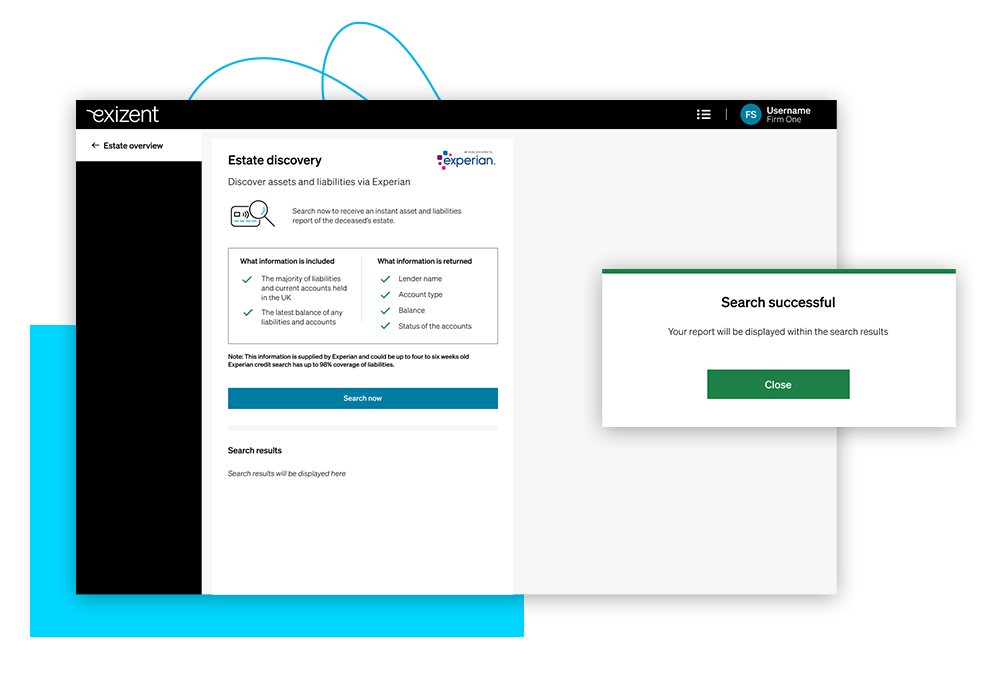

Probate professionals can now access Experian data directly within Exizent's platform, significantly speeding up the probate process.

With integrated estate discovery, working probate cases has never been easier

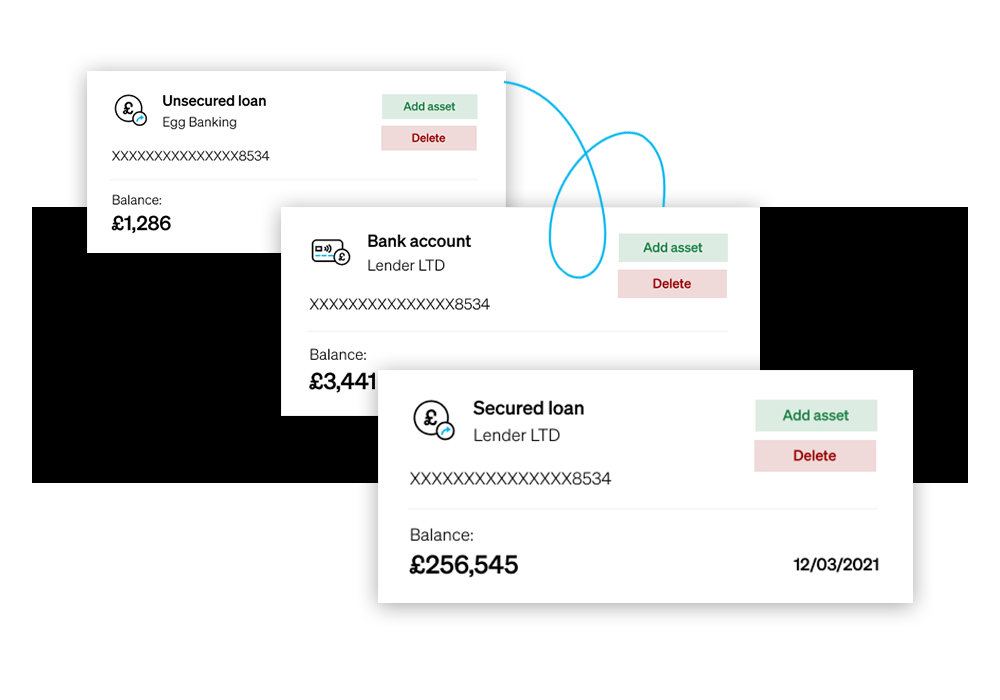

Access an Experian report and discover deceased’s key banking assets and financial liabilities in seconds, a process that can take solicitors many weeks to complete.

Simplify client work with integrated estate discovery

Quickly locate unknown assets and financial liabilities associated with an estate, removing the burden and reliance on client knowledge. Confirm and validate known assets more reliably, with the click of a button via the Experian data.

A simpler way to manage your probate process

Faster processing

Reduce time spent contacting institutions where assets are unknown. With integrated estate discovery you can process probate cases quicker than ever.

Locate assets and verify details

Reduce the burden and make the process easier for your clients, find assets and liabilities directly from the platform within seconds with a click of a button.

Minimise risk

Improve due diligence with minimal effort. With integrated estate discovery, solicitors can certify there are no hidden assets or liabilities, ensuring they have a detailed estate overview.

A financial burden

60%

Of law firms say less than half of their clients have all their affairs in order

37%

Of accounts are not known at the start of the process

5%

Of cases, no assets were known at the start of the process

26%

Of law firms say between 20 and 30% of assets are unknown