Recent updates

08 February 2022

Updates to existing forms

Following the introduction of new forms by HMRC and HMCTS from 1st January, the new versions of the forms have been updated on the platform. The forms available within each case on the platform are now determined by the deceased’s date of death to ensure users access the correct version, in line with the new excepted estates rules.

| Form | Date of death up to 31/12/2021 | Date of death 01/01/2022 onwards |

| IHT205 | ✔️ | ❌ |

| IHT217 | ✔️ | ❌ |

| C5 | ✔️ | ❌ |

| C5 (SE) | ✔️ | ❌ |

| C1 (2021) | ✔️ | ❌ |

| C1 C2 combined (2021) | ✔️ | ❌ |

| C1 (2022) | ❌ | ✔️ |

| C1 C2 combined (2022) | ❌ | ✔️ |

The new PA1A and PA1P forms are available on all cases regardless of the deceased’s date of death.

IHT400 usability improvements

- Main IHT400 form and schedule data is automatically refreshed with the most recent case data every time a form is opened

- £0 figure is automatically populated in the main IHT400 form when there is no corresponding schedule value to auto populate to save users time

- Full IHT schedule form names are now displayed in your case to help easily identify the asset types in each schedule

- Easily create additional schedules when you run out of space or if you need an additional schedule to record each asset individually

Check out our latest knowledge base article, below, to see the new functionality in action.

More IHT400 schedules prepopulated with platform data

IHT421 Probate Summary

- Deceased details are prepopulated

- Corresponding values from the IHT400 or IHT400 schedules are automatically populated

IHT409 Pensions

- Lump sum pension values and scheme details pulled through to questions 13 and 15

- New pension schedule automatically created and named for each pension

IHT407

- Miscellaneous items tile has been updated to allow you to categorise miscellaneous assets as “Antiques, works of art or collections”, “Jewellery” or “Other household and personal goods”

- All household and personal goods details already entered in the case are prepopulated in the IHT407 schedule

Benefits

- IHT400 schedules automatically generated for these three asset types as well as the IHT406 for bank accounts

- Forms are securely stored and organised in your case

- No need to start a form again if you make a mistake, the platform populates the latest case information every time you open a form

- Saving time: No need to re-key information or download each schedule individually

- Improves accuracy by reducing the risk of details being copied across incorrectly

Other enhancements

Editable tax threshold

Following user feedback, the tax threshold is now editable in every case to allow users to reflect any tax reliefs or exemptions being applied to the case.

For details on how to use this feature, check out our new Knowledge Base article here.

Business and partnership interests

Business interests now have their own asset tile at the end of the asset ribbon of each case dashboard with customized fields to help users track all the relevant details about the business.

22 November 2021

Feature enhancements

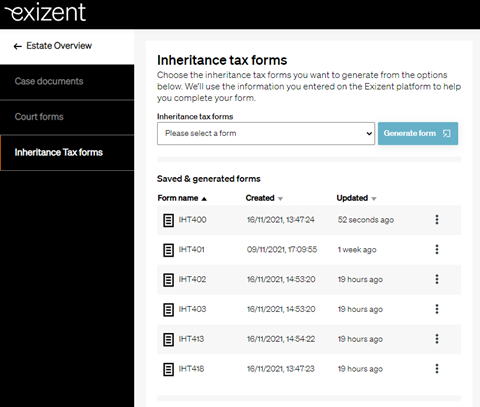

IHT400 usability improvements

- Edit the full IHT400 suite directly on the platform

- Save all IHT400 forms in your case automatically

- See a simplified list of all schedules generated in the case by form name, showing the date the form was created and last updated.

- Get corresponding schedules automatically generated after being ticked in main IHT400 form pages 5 and 6. Equally, schedules are automatically ticked in main IHT400 form pages 5 and 6, when they are created manually.

- View created schedules automatically ticked in the declaration on the main IHT400 form on page 13

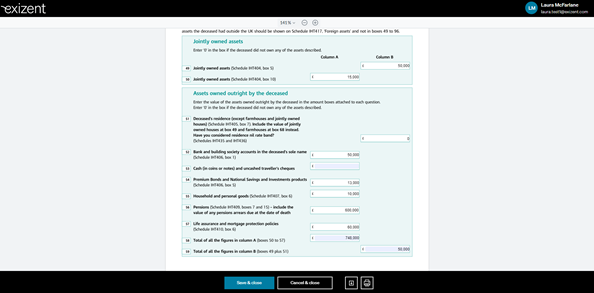

IHT400 schedule values and totals prepopulated in the main IHT400 form

There are 25 questions in the main IHT400 form which ask for values from the supplementary schedules. When a user manually enters values in the IHT400 schedules, these values will now pull through to the corresponding fields in the main IHT400 form.

Benefits:

- Over 75% of the main IHT400 form fields prepopulated with case data

- Reduce the risk of values being copied/entered incorrectly from corresponding schedules

- Speed up the IHT400 form completion process by notably reducing data re-entry

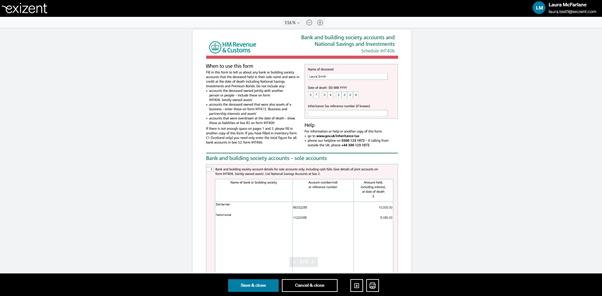

IHT406 schedule prepopulated with platform data

All solely owned bank or building society account details, already entered in the case for the deceased, are prepopulated in the IHT406 Bank and building society accounts and National Savings and Investments schedule. If two IHT406 schedules are required, your IHT400 will be automatically updated with the sum of the values from all IHT406 forms.

Benefits:

- 100% of the IHT406 form fields prepopulated with case data

- Save time, no need to re-enter the same data again in the schedule

- Improve accuracy, reduce the risk of bank account details being copied across incorrectly

05 November 2021

New features

Estate accounts feature preview

To give customers visibility of the new Estate accounts feature in development, we have added placeholders for all the sections we will start to populate with case data in the coming months.

In your case dashboard you will now see an Estate accounts option on the left-hand side, here you will see the placeholders for our 7 new Estate accounts sections.

We are working on populating your case data in the Estate accounts sections one by one. The first section being tackled is populating the Estate capital tab with a simple list of all assets and their date of death values.

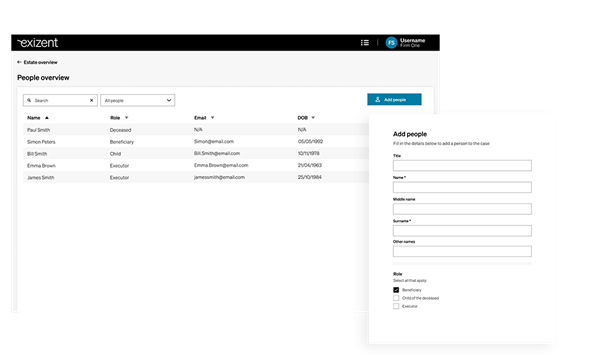

Feature enhancementsNew People section (previously Deceased & executors)

We previously had a Deceased & executors option on the left-hand side of your case dashboard with separate sections within this for the Deceased, Executors and Children of the deceased. We have upgraded this part of the platform to the People section.

In the new People section, you can now add a broader spectrum of people to your case and assign them multiple roles, significantly reducing rekeying of data. For example, the same person may be recorded as an executor, child of the deceased and a beneficiary all within one record.

Benefits:

- Add beneficiaries

- track their relationship to the deceased

- record key contact details

- note their bank details for easy estate distribution later

- Select from a wider range of family members and friends to show the relationship to the deceased

- See a list of all the key people involved in the case on 1 page with roles and email addresses displayed

23 September 2021

New features

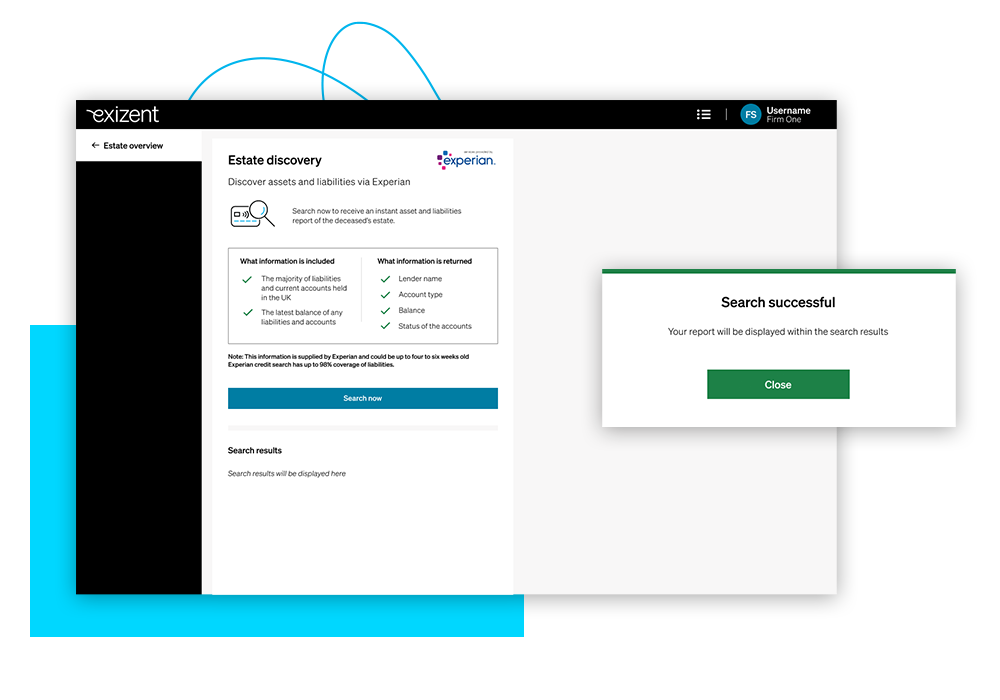

Estate discovery

This functionality allows eligible customers to instantly access an Experian report, showing a list of the deceased’s assets and liabilities to speed up the process of capturing the asset and liability information for each estate. As one of the big three credit reference agencies, Experian has great UK coverage. Current accounts and liabilities like mortgages, credit cards and loans will show up in the report to give you a great starting point to collate information about the estate. As more assets become digital with less of a paper trail, the Experian report will be extremely useful to minimise the risk of any assets or liabilities being missed out of the estate.

The Estate discovery feature will be free to access during the initial subscription term of our current customer’s contracts.

Benefits

- Access an Experian report about the deceased within seconds on the platform

- Save and securely store the report directly in your case for future reference

- Speed up the estate discovery process and reduce the burden on executors

- Reduce the risk of assets or liabilities being missed out of the estate

If your company has passed our comprehensive KYB check, the new Estate discovery feature will already be visible in the platform for you

Your Experian report will be saved in the Estate discovery tab for future reference.

2 July 2021

New features

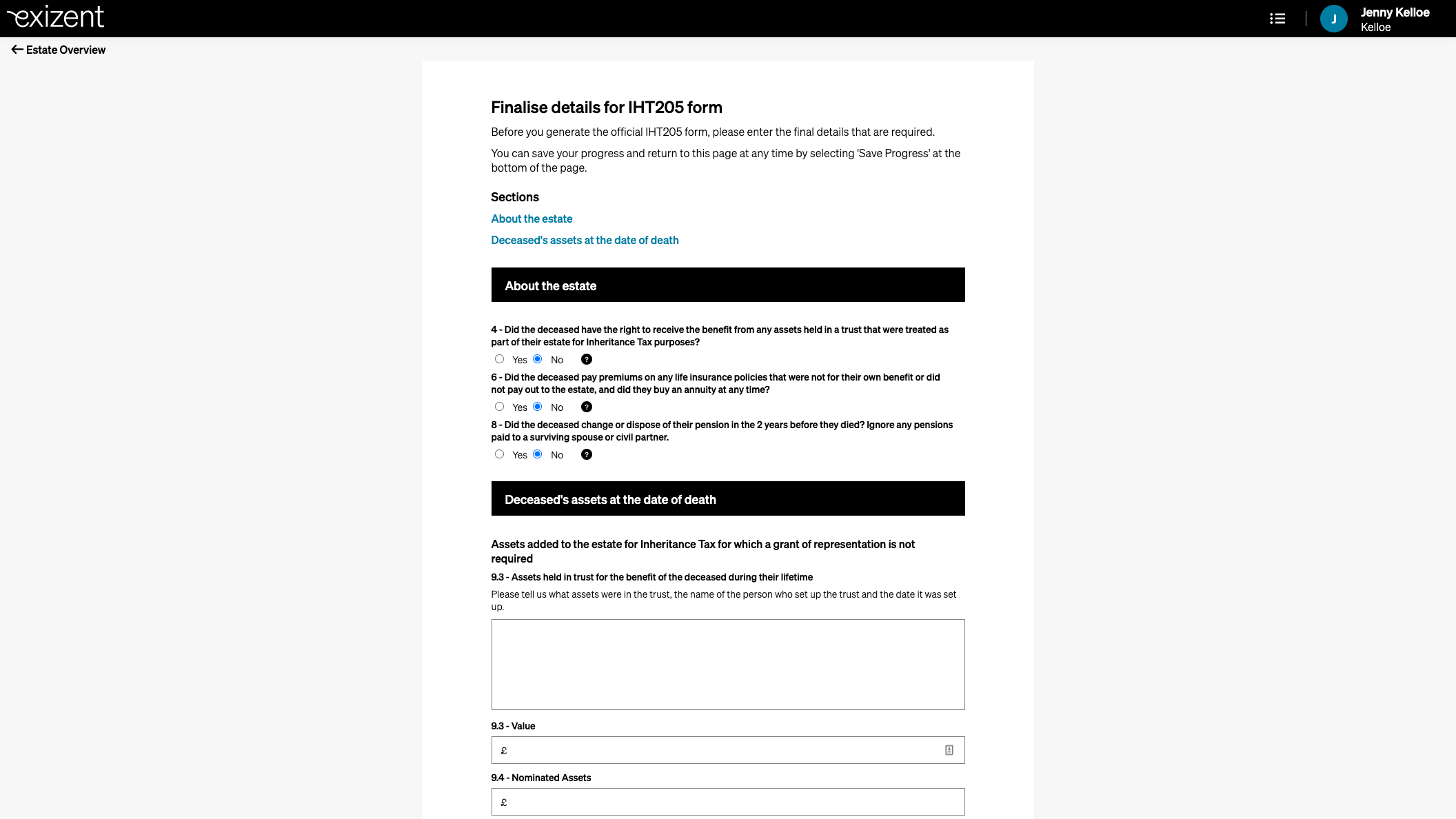

Improved IHT205 forms

Prepare final IHT205 forms within minutes on the platform saving you time.

Feature benefits:

- Fully complete IHT205 from directly within the platform

- 85% of fields pre-populated straight from your case data

- We’ll guide you through the remaining 15%

- Saved and securely stored in your case for future reference

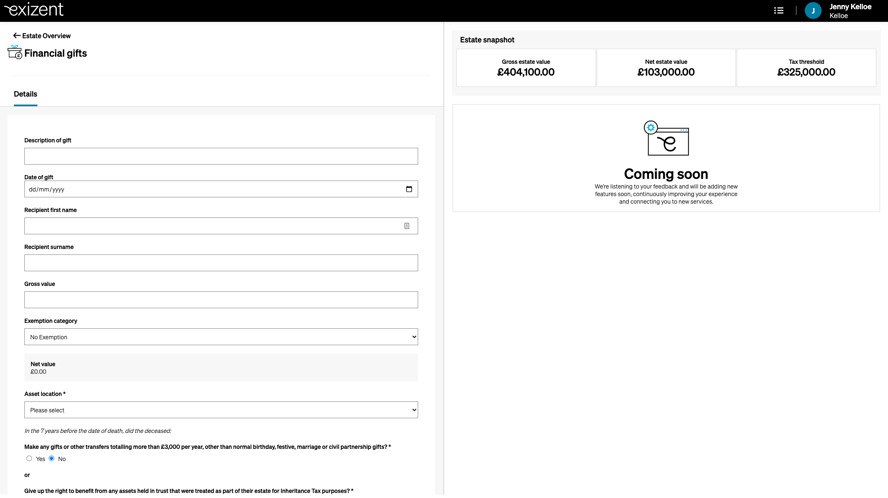

Updated gifts section

Accurately track and itemise individual gifts and their relevant exemptions to help with IHT calculations later.

How to access:

- In your case, click on the Add new financial gifts tile

- Enter the details for each gift and answer the standard gift questions required for your court and inheritance tax forms

5 May 2021

Progress so far:

- Prepopulated C1 confirmation court forms (October)

- Prepopulated PA1P and PA1A probate court forms (December)

- Our first version of the IHT400, with basic personal details populated (February)

- 2 versions of the IHT205, with our latest version prepopulating over 50% of the values (March)

Case export function

Extract basic case data (a list of assets, liabilities and a summary page with a net estate value total) to an Excel spreadsheet.

How to access: Simply click the “export case” button in the top right of your case. A pop-up window will appear then you can click “export” to download an Excel file.

Feature benefits:

- Extract data to perform calculations required for IHT forms

- Quickly update colleagues or clients on all the information collected about the estate so far

- Use the data to prepare estate accounts in your preferred format

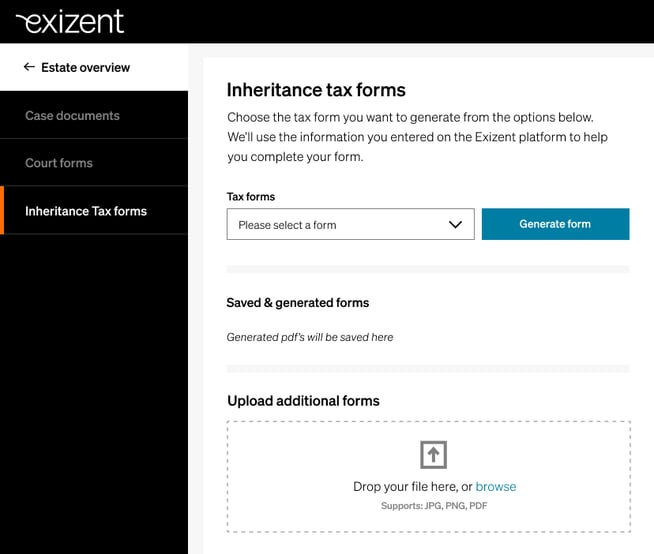

Forms update

We have created 2 new Court and Inheritance Tax forms sections to help accommodate existing court and IHT forms. This will ensure organised storage of important documents involved in a case. We have also added the IHT400 schedules, IHT216, IHT217 and C5 forms, prepopulated with the deceased’s name, date of death and inheritance tax reference number (where relevant).

How to access: On the left-hand side of the case dashboard, simply click the “Document & Forms” button. Within “Case Documents”, you will now see 3 tabs: Case documents, Court forms (to access C1 or PA1 court forms) and Inheritance tax forms (to access any IHT related forms).

Good to know:

- C1, PA1A/P and IHT205 forms are all stored automatically under “Generated forms” within the Court or Inheritance tax forms sections once the information in the forms editor has been completed and a PDF generated.

- When working on an IHT400 form or schedule, a C5 or IHT216 or IHT217 form, you can choose to download the form to edit and then use the “upload additional documents” feature to save these forms within your case.

Form Summary:

| Form | Where to access | Form storage | Form completion details |

| Court Forms | Inheritance Tax Forms | Automated saving |

Download & re-upload |

Majority pre-filled | >50% pre-filled | Partially pre-filled | |

| C1 | |||||||

| PA1P/A | |||||||

| IHT205 | |||||||

| IHT400 | |||||||

| IHT400 schedules | |||||||

| C5 | |||||||

| IHT216 | |||||||

| IHT217 |

Feature benefits:

- Court and IHT forms are securely stored and easily accessed in their own clearly defined area within a case

- Access all the additional IHT schedules and forms you need within your case in the platform without having to find and complete the forms elsewhere

- Complete IHT schedules as and when you need to in your own time

- Dedicated space for uploading additional documents or forms relevant to the case

- Minimises data re-entry - no need to repeatedly complete the same deceased details on each form

We are continually working on improvements and new features.

support@legal.exizent.com or 0141 846 1990

Bug fixes and other updates

- Improved saving messaging on all assets

- Added the ability to link assets to a debt

The Bereavement Index 2021

Gain access to Exizent's first Annual Bereavement Index, capturing the state of the nation on bereavement and it's related processes, taking legal, financial and emotional factors into consideration. Download now

Open Banking - where are we?

There is one untapped area of consumer finance that could be immeasurably improved by Open Banking, and that is estate administration. So, could we be utilising Open Banking more so alleviate this struggle? Read more

Webinar with Exizent's Daniel Fox

Daniel will identify the specific gaps and challenges legal professionals face while practising within current probate/conformation processes and why adopting technology is the key to future proofing your legal firm. Watch now